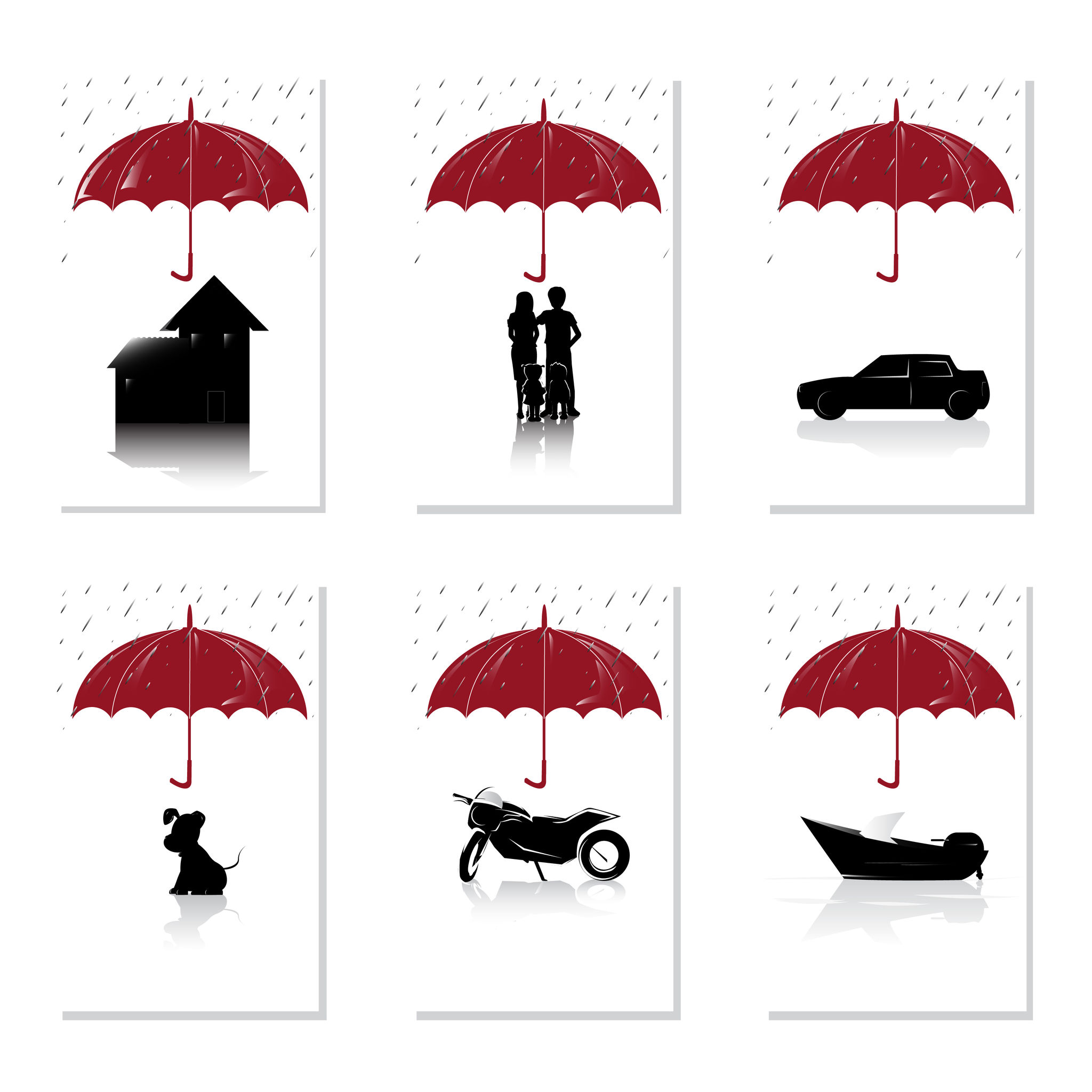

You may not live in a house or own a home but your still need to insure your belongings. That is why it is essential that you buy insurance coverage. An insurance plan for renters is quite affordable and can be used to pay for expenses if you happen to experience a loss of belongings or you must have your apartment restored because of a fire or weather event.

Why You Should Take Out Renter’s Insurance

Personal property protection, which is a primary component of a renter’s insurance plan, covers the replacement cost of your belongings if they happen to get damaged. The coverage applies to specific perils or risks such as a theft or fire. Some landlords require in their lease contracts that their tenants buy this type of protection. However, you should do so anyway. A lease’s terms do not include financial protection of your belongings if they happen to get ruined or stolen.

Insuring Your Assets

When assets are specifically covered in a renter’s insurance plan, it may also be referred to as home and contents insurance. This type of financial safeguard specifically protects your belongings from damage and theft. It also offers liability protection if someone is injured while visiting you in your apartment.

Loss of Use

To be more specific, you need to take out a renter’s insurance plan that is called an HO4 policy to make sure that your items are covered if they are ruined or stolen. You can buy protection that covers loss of use as well. For example, if you have to leave your home because of property damage, the policy will cover your hotel costs, food, and similar expenses.

Extended Protection

This type of plan can also cover events in which bodily injury or property damage stem from negligence. For example, if your dog happens to get away from you and bites your neighbor, you will be covered.

Enroll in Coverage Now, Not Later

To find out more about how this coverage can reduce risk and benefit you financially, contact the Ewing Insurance Agency at 123-456-0100. You can also learn more about the coverage by visiting online. Make the decision to enroll in the coverage now to receive full benefits. You can connect with them on Facebook for latest news and updates!