Getting home owner’s insurance can be a stressful process, as oftentimes it’s necessary to do this before you can complete the purchase of a home. Understanding what to look for can make this process easier.

What’s Covered

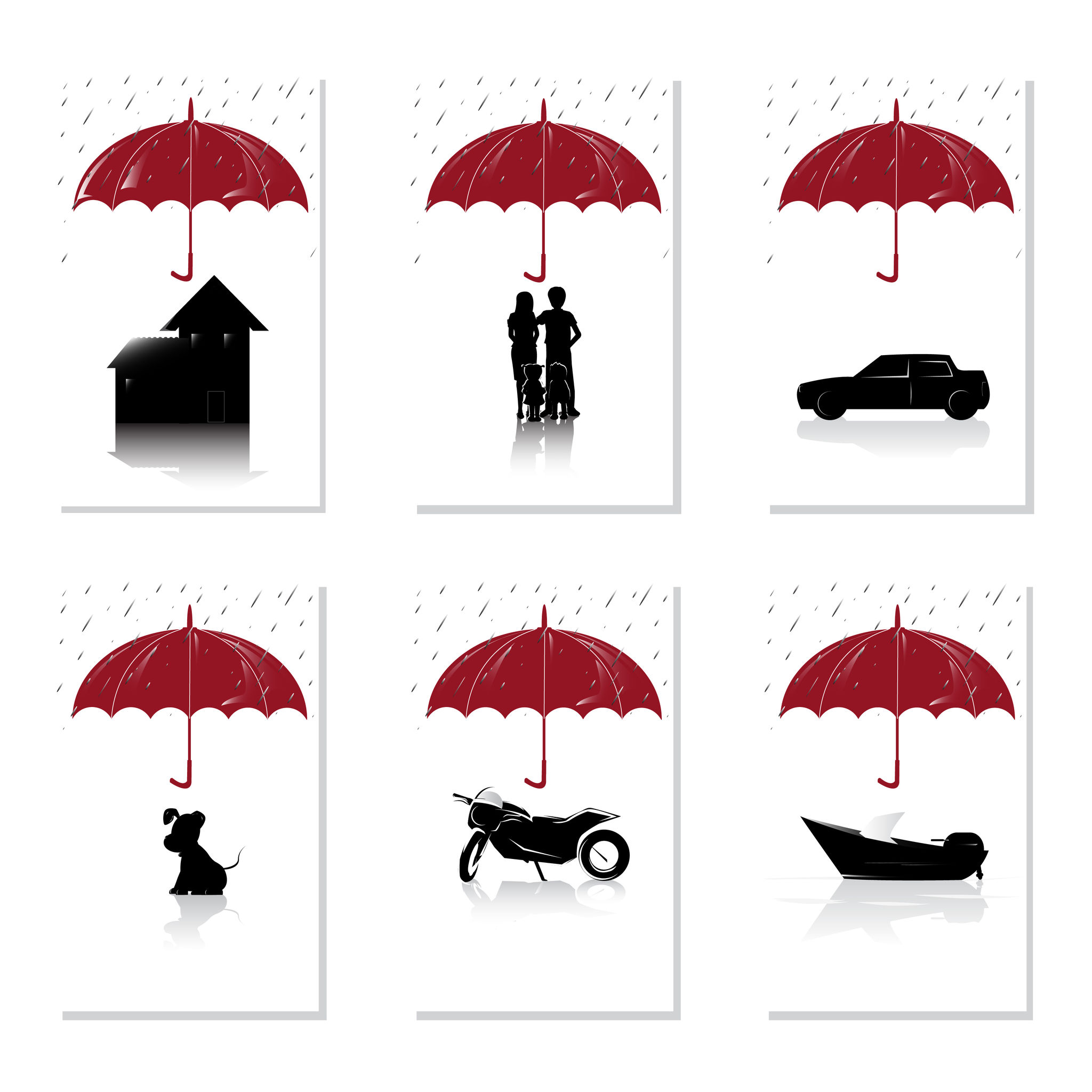

Home Insurance in Austin TX typically covers damage due to theft, the plumbing freezing, lightning, fire, hail or wind. Make sure to take a proper inventory of all valuables and add this to the replacement value of the house to figure out how much insurance is necessary. It also provides some living expenses in the case a person can’t live in the home due to damage covered under the insurance policy. Other structures on the property, such as sheds, garages and gazebos, are usually covered under the policy to some extent. Even some of the landscaping may be covered, such as shrubs, bushes and trees, but damage due to disease or wind doesn’t apply in this case. Policies typically include some liability coverage, which means property or bodily injuries to other people or their belongings by family members can be covered.

What’s Not

Any motor vehicles, aircraft or watercraft, won’t likely be covered under Home Insurance in Austin TX, nor will business pursuits or professional services. For coverage in case of floods, earthquakes, sink holes or home business insurance, it’s necessary to purchase additional policies that can be added onto the original homeowners policy. Regular home owners insurance also doesn’t cover sewage backups or damage due to neglect, such as insect damage, mold, rust, rot, rodents or birds. Nuclear damage and damage due to war are also excluded.

Potential Discounts

Insurance companies often offer discounts for purchasing multiple policies from the same company, having a claim-free history, using certain types of roofing materials, having a home security device or fire sprinklers or choosing a higher deductible. Living in a gated community, replacing old wiring, belonging to a homeowners association, being a nonsmoker and being a senior citizen can also lower home insurance rates, at least with some companies.

To find out even more about this type of insurance, call a State Farm agent like Patrick Court.